Sources of Edge - June 2025

Dear Partners,

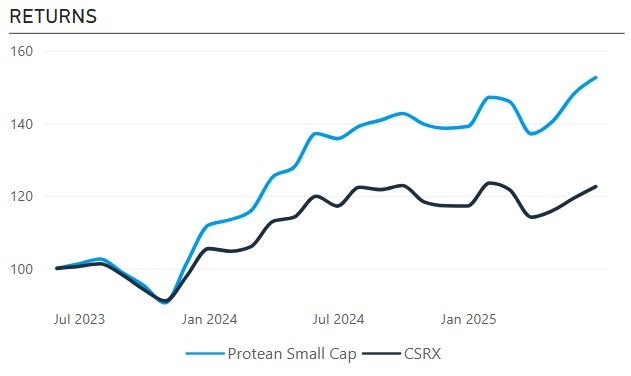

Protean Small Cap returned 2.9% in June, outperforming its index by 0.3% points. Year to date, the return is 9.7%. Since launching in June 2023, it has gained 52.6%, which is 30.1% points ahead of the Carnegie Nordic Small Cap Index.

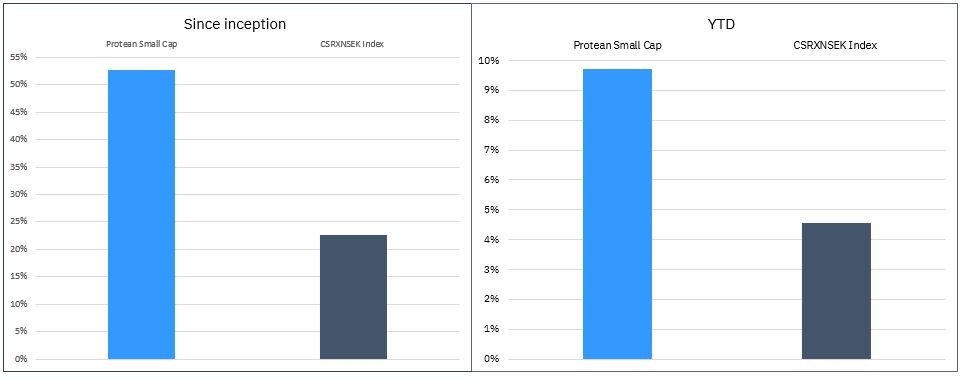

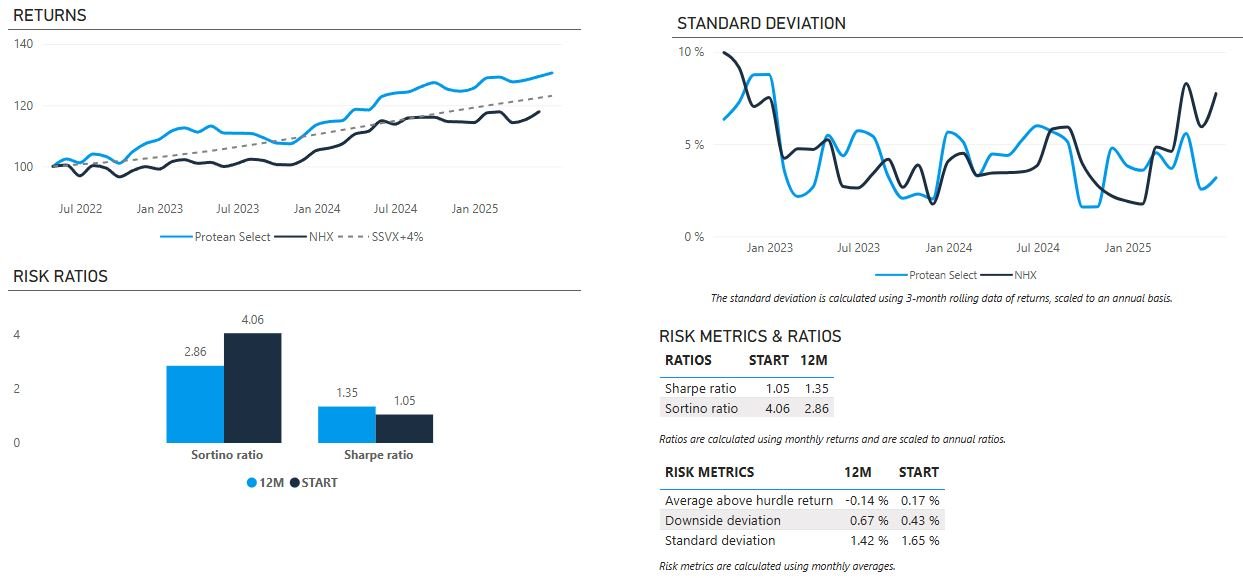

The hedge fund Protean Select returned 0.9% in June, staying true to its objective of generating reasonable returns and avoiding large drawdowns. Year to date the return is 3.9%.

Protean Aktiesparfond Norden, our recently launched fund that combines the low fees of passive funds with the active fund’s chance of beating the market, continues to do what we hoped it would do: outperform. Since inception three months ago it is up 8.9%, that is 5.2% points ahead of the index (VINX Nordic Cap SEK). It now manages >650m SEK.

This month’s letter elaborates on our new office space (we’re moving out of our little cupboard!), answers the question as to what we believe gives us our edge, and – as always – includes a handful of other stock observations and commentary, including a first ever contribution from our talented analyst Axel Ekros.

Thank you for being an investor!

// Team Protean

Building in public

The milestones are coming thick and fast. As June turns into July we welcome a handful of new investors to our funds, and this pushes our total assets under management over 3bn SEK. Three years, three funds, three billion!

We are acutely aware that you – our investors – can fire us at will, if and when we underperform for a prolonged period. This makes us both grateful and motivated.

In February 2022 we took our first office space: 17 square meters in a co-working space on Nybrogatan 34. We have since grown from two to five people in the team, and our upgraded 27 square meter office in the same co-working space is starting to get crowded.

Therefore, we today signed a lease for Protean’s first ever own office! True to form it is a quirky space with a focus on function, not your typical swanky glass-and-concrete block. Big enough to fit the team (and our plethora of computer screens), but small enough to exclude a foosball table and receptionist.

Committing to a three-year lease is a big thing, particularly for a young and risk-averse company like ours. However since we now have three distinctly different funds, and a reasonably successful track-record, we feel it’s time to take the next step when it comes to infrastructure.

Protean’s edge

“What’s your edge?” is perhaps the most difficult question to answer succinctly. Not least because you will look very silly yapping about your edge during the inevitable periods of underperformance. I mean, it’s a simple fact: if your returns are rubbish, you have no edge, or you don’t know how to utilize it. So, I take the opportunity to elaborate on what I think is our edge, and I reference that all our three funds have performed well for the past few years, but don’t rub my nose in it please, when we do badly…

Structural edge

We believe a core ingredient in our edge is structure. We are owner-operated and have all our own assets in our funds, creating a powerful alignment of interest. There is no investment committee causing consensus inertia. We have granted ourselves a very flexible and versatile mandate that excludes very few opportunities. In addition, our redemption/subscription process is structured to reduce liquidity risks.

We own our decisions personally and outright, and can change our minds quickly, helped by the one-PM approach for each fund. Our fund size control contributes to an important competitive advantage: our funds are small and are therefore able to be nimble. This is important, as it lowers the hurdle for course-correcting when we realize we are wrong. The size edge is substantial, we think, and this is why we cap our funds (not the Aktiesparfond, where the edge is low cost and long-term stock selection, and we compensate for the size disadvantage through low turnover and by lowering the fee as the fund grows).

It deserves to be underscored how different this approach is. Since fund management companies make their money off fees, why on earth would one restrict the size of the funds as a profit maximizing company? The answer is: as we try to optimize for performance rather than profits, we have chosen wildly differently.

For an international investor’s perspective, we also firmly believe our focus on the Nordics is a structural edge. There is little doubt – and the data supports it – that the Nordic markets combined constitutes the most attractive region for investing in the world. A combination of educational system, rule of law, political stability, natural resources and a vibrant equity and savings market, all make for a powerful set-up. The limited size of the home markets, plus the international outlook and export orientation, also contributes to why we have a disproportionate number of globally successful companies (and why they more often than not are listed on a stock exchange early in their journey).

Access and informational edge

We are local specialists through and through. The team has spent its entire working life consumed by Nordic markets, in various roles. We are familiar, to a varying degree, with most parts of the investing eco-system in the Nordics. We have experience working for listed companies, banks, brokers and asset managers from all the Nordic countries, from nomination committees and from financial newspapers. To a varying degree we know the local analysts, the local investors, the management teams, the board of directors, the owners.

As a fund company, we are set up to deal directly with all the relevant players in Scandinavia. Our list of counterparts, and the trading/research payments we make, contribute to Protean being a valued client. We also pride ourselves on being nice and approachable people, providing feedback and being responsive, handing out annual awards to our top brokers, and doing structured annual reviews. We actively cultivate a mutually beneficial relationship with corporate finance and ECM-desks.

The hurdle for an analyst to give us a piece of information should be low, and we believe it is. All this helps us in our search for informational edge – the best cases are often when you are early to something, when the case is half-baked, and you enter the trade with trepidation as it is yet to play out.

When even the slowest broker on the desk can comfortably regurgitate an appealing equity story by heart, the case might well already be over. This is why we want to be early, as a friendly speaking partner. Helping to formulate and develop ideas (speaking from experience: having an impressive roster of clients is a self-grinding accordion, as you get ideas and reverse-broking data points daily. Feeding this to your other clients makes you look very smart to all involved). The flip side, of course, is that when you ask for half-baked ideas, you inevitably get a lot of just that.

Behavioral edge

Tallying with the half-baked idea above, our investments often bear a touch of contrarianism, but they are all based on individual bottoms-up and fundamental risk/reward scenarios. Since we are so entwined in the local eco-system, we are sometimes also able to be our own catalyst: making sure our thesis or idea is brought to general attention.

As a fundamental principle, we try to employ a long-term perspective, which enables us to view market volatility as an opportunity rather than a risk.

To summarise

Edge is often defined as “the sustainable advantage that allows an investment manager to outperform markets”. This means it is very hard to have a succinct and clear answer, particularly as we are firm believers in changing markets – what works today might not work for the next few years – and trying to adapt. We simply don’t promise a particular style of investing, other than being truly opportunistic and focusing on positive fundamental risk/reward situations. If you invest with us, you need to be aware we are trying to utilize all the tools in the toolbox, and in changing those tools!

All we can promise is to try to generate reasonable returns, with reasonable risk, and to be invested alongside for the duration.

We believe it’s the most honest approach.

Protean Small Cap

– Carl’s update for June

Protean Small Cap returned +2.9% in June. That is 0.3% points ahead of the CSXRN (SEK) benchmark index for the month. We conclude H1 by being up 9.7%, which corresponds to 5.2% points ahead of index YTD.

Zooming out, this puts the fund 30.1% points ahead of our index (CSRXN SEK) since inception in June 2023. In total, performance since start is 52.6%. The fund now manages ca. SEK 650m. Thank you for your trust.

June re-cap

Main contributors in June were Devyser, Arjo, Boule Diagnostics, MT Hojgaard and Sinch.

Detractors include ITAB Shop Concept, Acast, Proact, Asmodee and Sdiptech.

Ossdsign has been a holding since start in Protean Small Cap. Step by step, we have gotten more confidence in the growth trajectory of this Swedish medtech. Their product is a nanosynthetic bone graft for bone formation, currently mainly used for spinal fusion surgery. In late June, Ossdsign published one-year results from its PROPEL registry. These were highly encouraging. Fusion rates reached 88%, despite a complex patient cohort. While the share performed strongly on this announcement, we believe the market fail to fully discount the long-term potential in Catalyst. We increased our position on the back of the results.

ECM activity is picking up and Protean Small Cap participated in two listings during the month: Enity and Sentia.

Enity is a provider of mortgages in the Nordics. It doesn’t compete head-on with the bigger banks. Instead, it provides mortgages for individuals that have issues getting a traditional mortgage. Despite this, Enity has a history of very low credit losses, averaging ca. 20 bps during the last five years. ROE is above 15%, growth ca. 10% p.a. and valuation remains attractive, despite a +20% gain since the listing.

Sentia is a Norwegian construction company, and the IPO was a sell-down from the Swedish investment firm Ratos, which is a holding of ours. Sentia’s CEO Jan Jahren has been with the group since 1997 and subscribed for shares worth NOK100m in the listing. We were also positively surprised by the strength of the balance sheet. Sentia operates with a large net cash position, which should be default for an asset-light construction of this sort. They also have a very low amount of contract assets on the balance sheet. We remain holders.

We’ve also made Sinch one of our top positions. Sinch has shown encouraging trends in cash flow generation, cost control as well as early signs of a return to organic growth. We believe that a share buyback program will be initiated following the Q2 results later this month.

The ten largest positions in Protean Small Cap as we enter July:

Protean Select

– Pontus’ update for June

*We illustrate our performance by showing a comparison with the NHX Equities index. This is an index constructed from the performance of 45 Nordic hedge funds focusing on equity strategies. NHX is published after our Partner Letter, so updates with one-month lag in the chart above. We aim to have positive returns regardless of the market, but no return is created in a vacuum, and a net-long strategy will correlate. Our hurdle rate is 6.2375% annualized (4% + 90-day Swedish T-bill). All figures are net of fees and ratios in the above charts are calculated using monthly returns.

June summary

Protean Select returned 0.9% in June, leaving the fund up 3.9% year to date. Volatility remains well below 6%.

Biggest contributors to returns were Devyser, Arjo and Novo Nordisk. Detractors include a basket of small cap shorts, short OMX index futures, and Essity.

Average net exposure for June was 26%, gross exposure 125%.

Staying active

As Protean Select is managed completely without regard to any index, the composition naturally diverges significantly from any index. The approach to index is one of curious contempt, where the observation rather is that the various indices and its changes, is a source of potential alpha as it often throws up significant mis-pricings.

After a presentation recently I got the feedback that “wow you really are a true opportunist without principles” and I took that as a real compliment. However, I do have a principle: try not to lose money.

Whenever there is a dislocation (or, one we perceive – we’re not always right) we are biased towards action. A good example is an intra-day trade in Stora Enso during June. Stora announced the intention to spin off their forestry assets before market open. My take was the event would initially be perceived to crystallize value, and that investors (and short sellers) would be looking to buy stock during the day. So, depending on where the stock opened, I figured there would be a trade for a smaller fund to get in early, and potentially offload stock later in the day as the stock drifted higher. My fundamental view is Stora Enso is challenged in its capital allocation, although some tentative improvements can be observed, and that the industry and pricing trends remain on a downward slope. Ergo: not something you want to own for the duration, unless you have a view one or the other is about to materially change for the better (which I don’t).

The stock opened up 10% (NB: where it also traded two months ago), and I aggressively bought a 1% position. A few hours later the stock was +18% and was showing signs of fatigue. I filled the remaining block-buyer, and pocketed 0.08% return net to the fund. In the two weeks since the trade, the stock is off 10%... (and now, at 9 EUR, I’m starting to wonder if it hasn’t underreacted to the said announcement).

In 2024 Protean Select had a turnover of close to 400%. One trade like this, on one day, contributes 2% points to that number. It adds up. But so does the return. And, I argue, with more limited risk.

Gränges – Axel’s contribution

Gränges has completed a multi-year expansion program — acquiring a plant in Poland, completed capacity expansion in Sweden and the US, and unexpectedly acquired a Chinese plant in late 2024.

However, the expansion program has taken more time and has cost more than expected. This has stretched investor patience, as it turned out to be far from the growth story anyone hoped for.

Our view is that Gränges was at the time of the IPO a company focused on a single niche: heat exchangers for vehicles. Since then, the company has broadened its offering into niche applications such as EV battery housing and specialty packaging. This reduces dependency on legacy automotive heat exchangers. This shift does not seem to be reflected in the valuation. Gränges now operates across multiple niches and avoids dependence on a single end market.

In a world where tariffs trigger alarm bells, we believe Gränges finds itself on the right side of the equation, with a structural tailwind that in fact enhances Gränges’ strategic position. Previously, most aluminum was rolled in Canada and transported across the border. Gränges offers regional rolling capacity, which has now become highly attractive. At the same time Gränges continues to gain market share across European automotive platforms despite industry skepticism.

Expansion investments are ending in 2025 and capex is thus halving to SEK 650 million. Current pricing is attractive at ~11-12% FCF yield for 2025-2026.

Heading into earnings season, foreign exchange effects might once again become a negative “surprise” line item. Discounted? Probably. But as every seasoned investor knows: a stock can rise or fall on the same piece of news multiple times. We are ready to see through the noise, as the stock offers compelling fundamental upside.

Protean Aktiesparfond Norden

– Richard Bråse

Aktiesparfonden is a Nordic long-only fund aiming to generate above-market returns over the long term by active investing in value-creating companies and charging a low fee. A fee that is reduced further as the fund grows, sharing the scale advantages with investors.

Aktiesparfonden, which is daily traded, has per the last day of June returned 8.9% since inception. This is ahead of the benchmark, VINX Nordic Cap, by 5.2% points.

Our communication for Aktiesparfonden is in currently only in Swedish and updates can be found at www.aktiesparfonden.se by clicking the headline “Anslagstavla”.

The fund now manages >650m SEK.

Thank you for your long-term perspective and trust in our process.

Richard

The monthy reminder

We optimize for performance, not for convenience, size, or marketing.

You can withdraw money only quarterly (monthly in Small Cap).

We tell you very little about our holdings.

Our strategy is tricky to describe as we aim to be versatile.

A hedge fund can lose money even if markets are up.

We charge a performance fee if we do well.

You do not get a discount if you have a larger sum to invest.

We do not have a long track record.

Aktiesparfonden’s reminder

We aim to generate above index returns over 3-5 years, but there are no guarantees.

The fund is daily traded, but that doesn’t mean you should.

To beat the index, you need to deviate from the index. This means taking uncomfortable positions.

Be aware that the fund can underperform the index during periods. Sometimes, long periods.

We lower the fee as the fund grows. The first 10 basis point cut comes at 10bn SEK in AuM.

Thank you for being an investor.

Pontus Dackmo

CEO & Investment Manager

Protean Funds Scandinavia AB